Welcome to my website!

I am a PhD Candidate at EPFL and the Swiss Finance Institute.

I am on the 2025–2026 academic job market.

My primary research interests include empirical corporate finance, in particular venture capital, innovation, and sustainable finance.

You can find my CV here.

I co-organize the student-led

Workshop on Entrepreneurial Finance and Innovation.

Job Market Paper

From D.C. to VC: Leveraging Government Expertise in Venture Capital

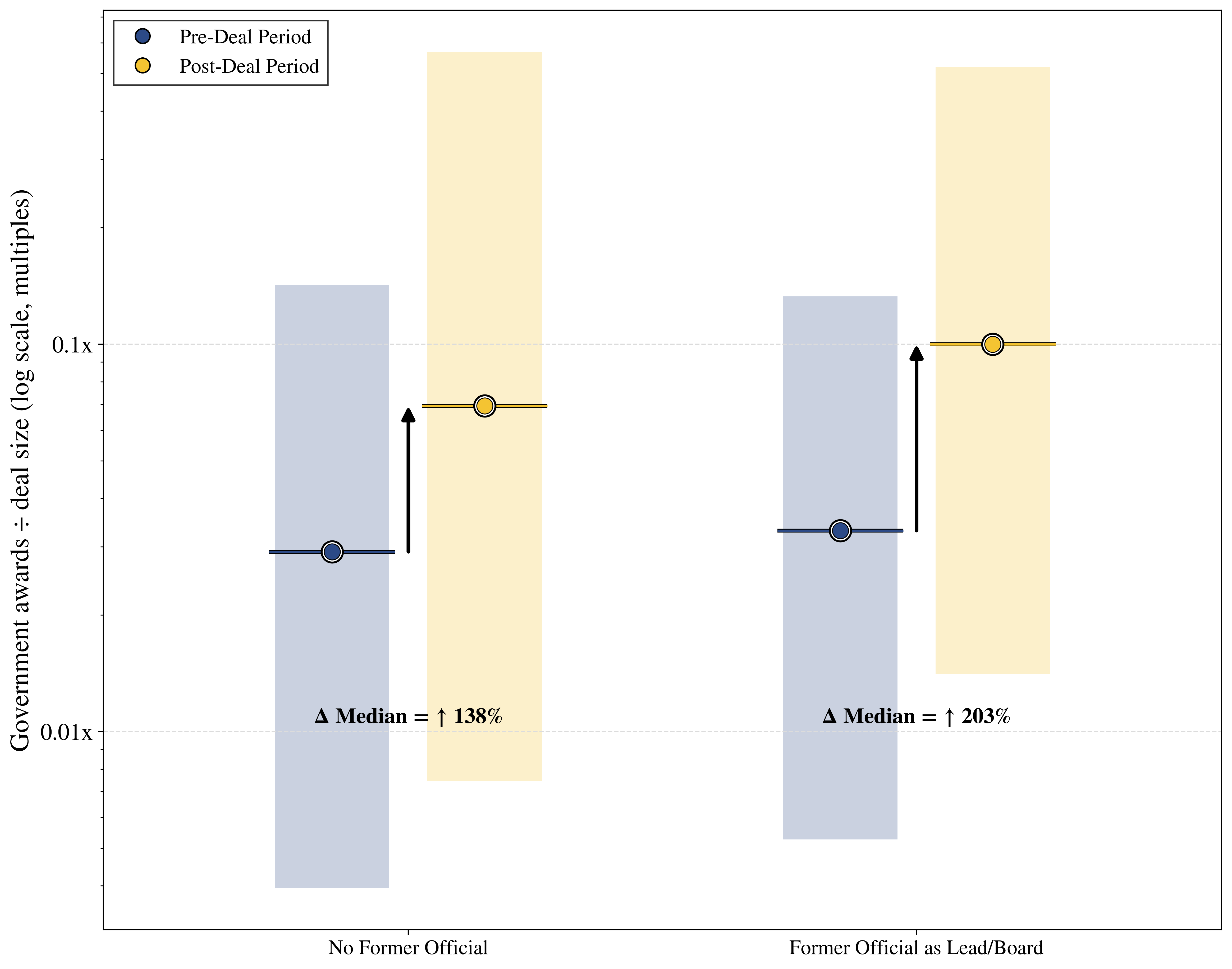

Abstract: Venture capitalists hire skilled professionals to screen and mentor portfolio companies from a variety of backgrounds. I build a new dataset linking career transitions from U.S. agencies into VC firms and document a rising flow of senior government officials into decision-making roles at startups and VC firms. Using a plausibly exogenous shock to the supply of former officials, I find that startups in which a former official serves as lead partner or VC-appointed director secure more federal awards and are more likely to obtain follow-on financing. Evidence from the timing of awards around cooling-off rules indicates that, beyond procedural know-how, relational access contributes to these gains.

Presentations: Workshop on Entreprenerial Finance and Innovation (WEFI) Fellow Conference (2025), UT Austin (brown bag), Baylor University (brown bag), Bocconi Doctoral Workshop in Entrepreneurship, Lugano Product Market Summer School

Other Working Papers

Involuntary Disclosures Through Climate Litigations: Impact on Investors and Corporate Policies (solo-authored) [Latest Version]

Abstract: I study the role of involuntary disclosures in steering environmental governance. Using a sample of climate litigations filed between 2012 and 2019, I examine whether these litigations shed new light on defendant firms’ climate risks and whether this information is relevant enough to trigger investors’ reactions and impact corporate policies. I find that on average climate litigations have no significant effect on firm value or on emissions, and do not lead to divestments by green institutional investors. However, cases that attract investors’ attention do lead to significant reductions in emissions for the defendant firms. In contrast, I find little evidence that climate litigations contribute to self-disciplining effects on non-targeted peer companies.

Presentations: AFA 2025 (poster session), 2024 Yale Initiative in Sustainable Finance, 7th Annual GRASFI Conference, 2nd European Sustainable Finance PhD Workshop, EHL Sustainable Investing Forum, SFI Research Days 2024, Alliance for Research on Corporate Sustainability (ARCS) 2024 Annual Conference

Can Unconventional Monetary Policy Contribute to Climate Action? (with Andrea Maino, PhD Student at University of Geneva) [SSRN]

Abstract: We investigate whether and how central banks can redirect financial flows toward decreasing the environmental footprint of firms. We focus on the July 2021 Monetary Policy Strategy Review of the European Central Bank, which unexpectedly dedicated a whole workstream to climate change. We find that this announcement had a significant effect on green bonds: ECB-eligible green bonds’ Yield-to-Maturity decreased compared to equivalent conventional bonds. Firms incorporated in the Eurozone reacted by increasing the amount of green bonds issued, particularly in the investment-grade segment. In contrast, we find that the announcement did not boost the probability of signing a Net-Zero commitment for Eurozone-incorporated firms, raising questions about whether central bank policies can influence firms’ longer-term policies.

Presentations: ECB Young Economist Prize (poster session), Sveriges Riksbank (poster session), University of Geneva (brown bag), European Commission JRC Summer School in Sustainable Finance, AFFI